Commercial Auto Insurance

Commercial Vehicle Insurance in NH & ME

When running a small business, it is important to protect every aspect of your entity, including any vehicles that are used during the course of your operation. Adding a commercial vehicle policy to your coverage plan is a viable option for reducing your financial liability in the event of an accident, theft or other loss.

At RW Insurance, our independent agents offer experienced advice to business owners throughout the Dover area, including in Somersworth, Rochester, Barrington, Newington, Durham, Newmarket, Milton, Rollinsford and Madbury, NH. Our relationships with multiple providers allow us to help you compare commercial vehicle insurance quotes for your business, regardless of the size of your entity or the industry in which you operate.

- Employee errors

- Accidents on your property

- Injuries to customers

- Damage to a customer’s property

- Accidents involving business vehicles

- Theft of personal data

Business Auto Insurance for Your Fleet or Company Car

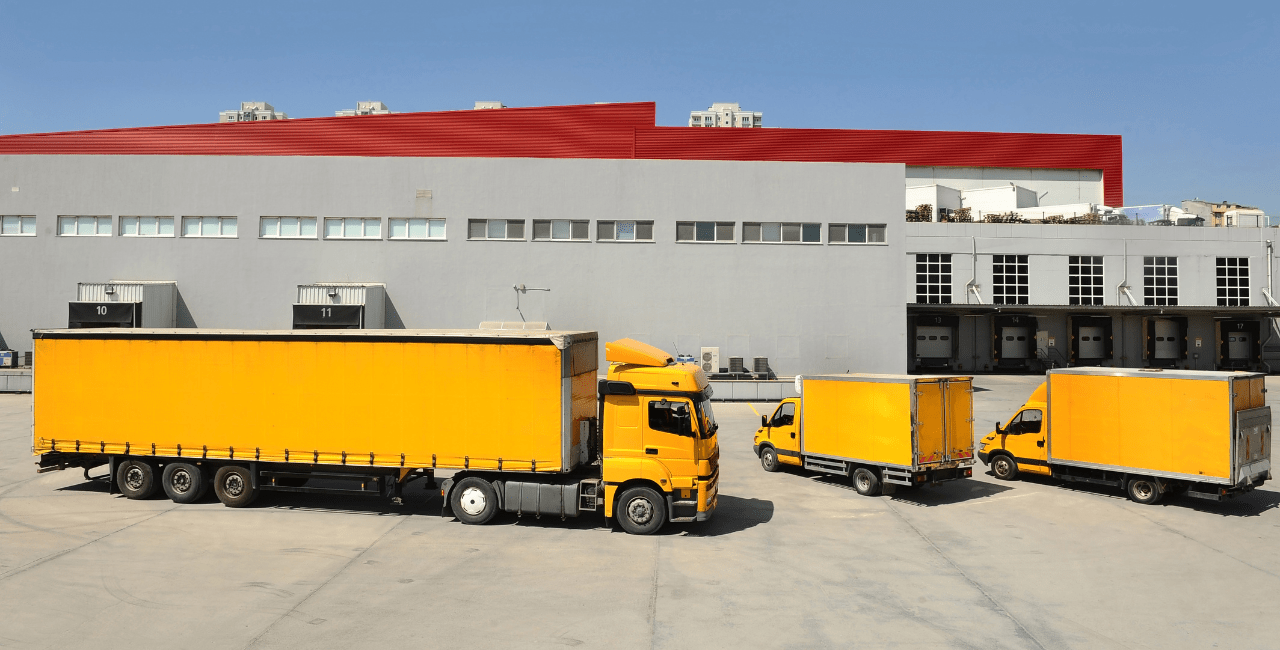

Whether you operate a large fleet of commercial vehicles, or need coverage for just a few business automobiles, we can help. Since 1920, we’ve helped business owners purchase fleet insurance for a wide range of vehicles, including contractor’s vans, medivac, delivery vans, semi-trucks and heavy equipment.

After carefully reviewing your business, your fleet and your goals, we will carefully gather quotes for policies that offer the benefits and protection you require:

- Accident coverage: Accidents involving your commercial vehicle can be very costly. From repair or replacement expenses to medical bills, even the smallest collision can lead to serious hardship if your vehicles are not adequately covered. Commercial auto policies offer protection against the expenses resulting from an accident.

- Liability: If another party is injured in an accident involving one of your fleet vehicles, you may be responsible for their medical care, lost wages and any other losses they may incur. In many cases, your commercial fleet insurance will cover these expenses, in turn limiting your out-of-pocket payments after an accident.

- Theft: The theft of a vehicle or equipment can dramatically impact your ability to do business. Business auto policies offer protection against the costs associated with replacing a stolen vehicle or equipment.

- Affordable premiums: To keep your rates to a minimum, we will gather multiple quotes from some of the industry’s top providers. We also offer advice on money saving options, including multi-policy discounts for purchasing your business coverage, workers compensation or general liability insurance from the same provider.